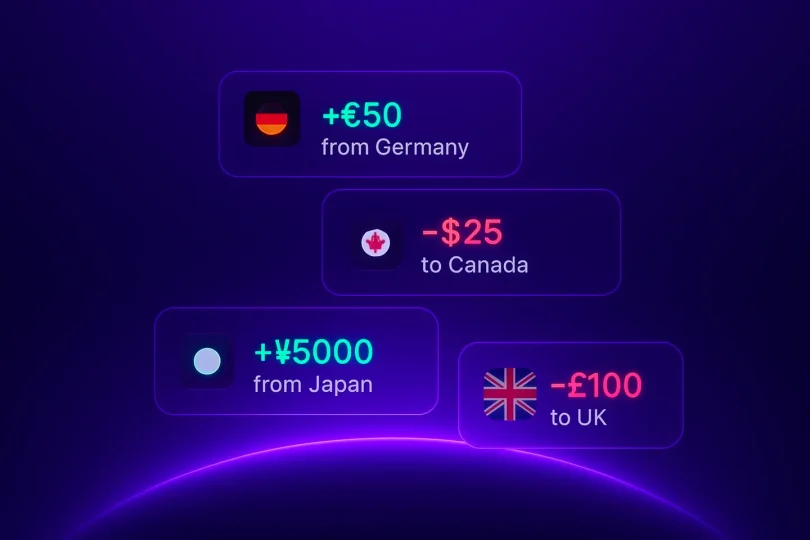

Send money worldwide instantly with complete privacy and transparent pricing.

The most efficient method for sending money internationally is through bank transfer gift cards. These cards offer instant delivery, competitive exchange rates, reduced fees compared to traditional banks, and enhanced privacy protection. Processing is instantaneous within Europe and takes only 1-4 business days for worldwide transfers. The service supports over 40 currencies and does not require any verification.

Table of contents

- How do International money transfers work?

- Different ways for sending money abroad

- Why choose bank transfer gift cards?

- How to send money internationally

- How long will your transfer take?

- What does it cost to send money abroad?

- FAQs

How do International money transfers work?

International money transfers facilitate the movement of funds through banking networks such as SWIFT (for global transfers) or SEPA (for European transfers). Each network operates with varying speeds, costs, and requirements, directly influencing the transfer’s cost and duration.

Factors that impact your transfer include:

1. Transfer Method: The chosen method (e.g., SWIFT, SEPA) determines the network’s speed and associated costs.

2. Currency: The currency involved in the transfer affects the exchange rate and associated fees.

3. Transfer Amount: Larger transfer amounts may incur higher fees and processing times.

4. Transfer Time: The time required for the transfer to complete depends on the chosen method and network.

Understanding these factors helps you make smarter choices about how to send your money.

Different ways for sending money abroad

The primary methods for sending money abroad include bank transfer gift cards (the fastest and most private option), online money transfer platforms, traditional bank wire transfers, and cash pickup services. Each method has distinct costs, speeds, and requirements.

1. Bank transfer gift cards

A bank transfer gift card is a prepaid code that can be redeemed for an instant bank transfer. You purchase it online through our Rewarble partners, receive a code immediately, and your recipient receives the money. There are no complicated forms, no sharing of sensitive bank details, and significantly lower costs compared to traditional methods.

2. Other online money transfer platforms

Digital payment services enable users to transfer funds via mobile applications or websites. While convenient, these services necessitate account creation, identity verification, and often a delay of several days in fund delivery. Fees fluctuate significantly across different platforms.

3. Cash pickup services

Services like Western Union let your recipient collect cash at a local office. It’s quick for emergencies but expensive – often charging 3-7% of your transfer amount. Your recipient also needs to travel to a physical location.

Why choose bank transfer gift cards?

When selecting a gift card option, consider bank transfer gift cards, which offer the reliability of SWIFT and SEPA networks. Our approach distinguishes itself in several key ways:

Speed:

Upon purchase, gift cards are instantly delivered via email, eliminating the need for bank approvals or business hours. Users can then select their desired transfer speed.

Privacy Protection:

Unlike traditional transfers, where banking details traverse multiple institutions, our gift cards safeguard user information. Users remain anonymous, and recipients are solely informed of the incoming funds.

Transparent Pricing:

Traditional banks conceal fees within exchange rates. Our gift cards provide upfront, transparent pricing, eliminating surprises and hidden markups that can diminish transfer value.

Global Accessibility:

Gift cards can be sent to any bank account worldwide, including EUR, USD, GBP, and 11 other currencies. Major banking networks are fully supported.

Streamlined Verification:

For smaller amounts, users are not required to verify their identity or complete intricate forms. The process is akin to purchasing any other gift card online.

How to send money internationally

To transfer funds using bank transfer gift cards, follow these steps:

1. Exchange Funds: Visit ChinaitechPay, select the desired amount, and complete the purchase. You will receive a digital code via email within seconds.

2. Access ChinaitechPay: Enter your payment method for the transfer. No account is required; only your email address is necessary for quick access to the link.

3. Add Recipient: Select SWIFT or SEPA, then enter the recipient’s bank name, account details, and amount.

4. Confirm and Send: Double-check the details and click “Confirm.” Your transfer will commence immediately using the most efficient route available.

Additional Information: Your gift card generates a balance that can be utilized for multiple transfers. You can send funds to different recipients or reserve some for future use, as it is entirely up to your discretion.

How long will your transfer take?

Your transfer will be processed instantaneously using SEPA (within Europe) or within 1-4 business days using SWIFT (worldwide) when utilizing bank transfer gift cards. SWIFT and SEPA are the most trusted and reliable payment networks globally. SWIFT facilitates global bank connections, while SEPA enables instant European transfers. With our gift cards, you gain access to both these established networks without the customary banking complexities.

What does it cost to send money abroad?

Bank transfer gift cards incur a fee of 4.9% plus €0.49, in contrast to other services that may charge up to 7% when considering all hidden fees, exchange rate markups, and intermediary charges.

Our transparent approach:

- See your exact cost before you buy

- Exchange rates close to mid-market rates

- No surprise deductions along the way

FAQs

Is this really safe for large amounts?

Absolutely. We use the same secure banking networks as traditional transfers , SWIFT and SEPA. The difference is in how you pay for the transfer (with a gift card) and how we route it (faster and more efficiently). Every transfer is encrypted and processed through regulated financial institutions.