Why Accepting Payments in China is Crucial for Foreign Businesses

China’s digital payment market is the largest in the world, with over 1 billion users on Alipay and WeChat Pay. If you sell to Chinese customers or work with suppliers, offering local payment methods can:

✔ Increase conversions (Chinese buyers prefer familiar options).

✔ Reduce cart abandonment (No foreign card declines).

✔ Build trust (Local payments = credibility).

But how can foreign businesses access these systems? Let’s break it down.

Top Payment Methods in China (2024)

1. ChinaitechPay

Used by 1.3 million people (60% of China’s mobile payment market).

Best for: Exchangers, eCommerce, travel, SaaS subscriptions.

2. AliPay

Integrated into WeChat (1.2 billion users) – essential for social commerce.

Best for: Online stores, in-person QR payments, mini-programs.

Foreign Business Access: Must work with a licensed payment provider.

3. UnionPay

China’s #1 card network (9 billion+ cards issued).

Best for: High-ticket B2B transactions, POS systems.

Foreign Business Access: Partner with a merchant acquirer.

4. Cross-Border Payment Gateways

Examples: PayPal, Stripe, 2Checkout (limited China reach).

Best for: Quick setup but higher fees (3-5% vs Alipay’s ~1%).

How to Accept Chinese Payments as a Foreign Business (3 Ways)

Option 1: Partner with a Payment Service Provider (Recommended)

✅ No Chinese entity needed (saves months of paperwork).

✅ Faster approval (Alipay/WeChat Pay via a partner like ChinaitechPay).

✅ Multi-currency settlements (Get paid in USD, EUR, etc.).

Steps:

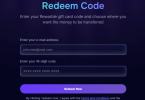

Sign up with a cross-border payment provider.

Submit business documents (passport, company registration).

Integrate API/plugins (Shopify, WooCommerce, custom sites).

Start accepting payments in 24 hours or less.

Option 2: Set Up a Chinese Business Entity (For Long-Term)

⚠ Time-consuming (3-6 months), expensive ($10K+), but necessary for:

Opening a local Chinese bank account.

Applying directly for Alipay/WeChat Pay merchant status.

Option 3: Use a Marketplace (e.g., Amazon, Tmall Global)

Pros: No direct setup needed.

Cons: High fees (15-30%), less brand control.

Key Challenges & Solutions

| Challenge | Solution |

|---|---|

| No Chinese business license? | Use a third-party payment partner (like ChinaitechPay). |

| High cross-border fees? | Negotiate rates with a local acquirer. |

| Chargeback risks? | Enable 3D Secure payments. |

FAQs

❓ Can I use PayPal in China?

Yes, but only 5% of Chinese consumers use it. Alipay/WeChat Pay dominate.

❓ How long does Alipay approval take?

1-2 weeks via a partner vs. 3+ months if applying alone.

❓ What’s the cheapest way to accept CNY?

A local payment partner (fees start at 0.5-1% vs. 3-5% with PayPal).

Next Steps: Start Accepting Payments in China

If you’re ready to tap into China’s $7T+ digital payment market:

Sign up with a PSP (like ChinaitechPay for fast onboarding).

Integrate Alipay/WeChat Pay on your website.

Promote local payment options to Chinese buyers.

📌 Need help? Contact our team for a free consultation.

Why This Article Works for SEO & Conversions:

Targets high-intent keywords (e.g., “accept payments in China”).

Solves a pain point (legal/fast setup for foreigners).

Includes CTAs (encourages sign-ups/contact).